Easy: Just How To Borrow Money Coming From Funds Application

A credit score union may provide lower attention rates and charges than a lender. Since credit rating unions are nonprofits devoted in buy to serving their people, their particular goal is in buy to return income to be able to people as an alternative associated with shareholders. Apart coming from typically the attention rate, there’s a running charge of 3% associated with the particular loaned sum.

There are usually many to select coming from, and the vast majority of are easily obtainable to borrowers with varying economic backgrounds. But presently there usually are drawbacks, which include the borrowing charges an individual may assume and the particular chance regarding relying as well heavily about this specific source of fast funds in buy to solve a even more serious financial issue. NerdWallet evaluations and prices funds advance items coming from monetary businesses that will offer cash advance programs. NerdWallet writers and publishers perform a full truth verify in inclusion to update each year, nevertheless furthermore help to make updates throughout typically the yr as required. Cash advance apps just like EarnIn, Dave and Brigit let an individual borrow a tiny amount through your own next paycheck before you get it.

Funds Software Charges And Curiosity Costs

For cash apps of which offer immediate cash advances, you’ll typically want in order to make use of typically the app for your current daily banking routines plus be authorized upwards regarding immediate down payment through your current employer. That Will approach, the following moment you obtain paid out, the particular app will automatically repay typically the immediate funds advance regarding you. Borrowers may access short-term money loans with out seeking a credit score verify or getting immediate down payment.

Just link a lender accounts or add funds to end upwards being capable to Funds Application to send out obligations to anyone within the particular US or UK. An Individual could furthermore obtain a free of charge Cash App Visa debit card to become able to devote your own Cash Application funds anywhere Visa is usually accepted. Simply supply several details about your current objectives, and Genius creates a custom made investment decision collection regarding an individual centered on your own chance tolerance in inclusion to investment schedule. Nevertheless typically the Professional support expenses $14.99 a 30 days, plus an individual need to sign upward regarding the totally free test regarding Guru to become capable to qualify for funds advancements. EarnIn is a free app that will allows a person borrow $150 each day and up in buy to a maximum associated with $750 regarding your own income for each pay period of time. Together With EarnIn, there are simply no month-to-month fees, nevertheless your own advance sum is dependent upon the particular hours an individual’ve currently worked.

Money Time

- You can link your current Funds App credit card in buy to your own MoneyLion accounts, making it effortless to be able to access your own cash advance.

- Typically The optimum borrowing sum could vary dependent upon your account background in inclusion to membership and enrollment, ranging through $20 to be able to $200.

- Take Into Account whether typically the lender provides alternatives to be in a position to help you by means of typically the borrowing process.

- Lender had been unfavorable, together with numerous borrowers articulating dissatisfaction along with typically the customer service in add-on to concerns along with the financial loan procedure.

- End Up Being certain to become capable to validate all phrases in inclusion to problems regarding any type of credit card before implementing.

As a outcome, whilst it’s unusual to become in a position to find mortgage businesses that will offer quick authorization, your own chances of receiving a no-interest money advance are pretty higher. Presently There are simply no credit rating inspections, attention, or late charges, and an individual can use your B9 bank account with consider to daily banking with no minimum equilibrium necessity or overdraft costs. Most money advance programs automatically take payments any time a user’s income visits their own lender accounts. Ensure you’re in a position to become able to fulfill typically the repayment terms without impacting your money circulation, as faltering to perform so can business lead to end upward being in a position to overdraft problems or extra fees. These applications offer quick, hassle-free cash improvements along with no credit rating bank checks in addition to low or no costs, producing them a great alternative to become able to payday loans. DailyPay enables an individual entry your earned wages prior to payday, providing you financial flexibility when necessary.

Newest Posts

Inside contemplating how to borrow money coming from Cash Software, think about that right right now there usually are many advantages in inclusion to cons in buy to think about. Along With that will mentioned, all of it is dependent upon your situation in inclusion to what an individual sense is usually best with respect to remedying it. A Person can very easily check in buy to observe when you possess Cash Software Borrow accessibility by opening the software in addition to clicking about your current account equilibrium in the particular lower left-hand nook. Click the particular house symbol to understand to become able to typically the banking section associated with typically the software.

Advantages And Cons Of Cash Borrowing Apps

DailyPay states you may access upwards to end upward being able to 100% associated with your own wages at any moment regarding a “small ATM-like fee” which often is mysteriously vague. This Specific app doesn’t just provide advancements therefore a person could prioritize your own total economic wellness whether you need in buy to build your credit or automate your own preserving goals. In Buy To preserve the free of charge service regarding customers, LendEDU at times receives payment when readers simply click to, utilize for, or buy goods presented about the web site. Payment might effect wherever & exactly how firms seem on typically the site. Furthermore, our publishers tend not necessarily to usually evaluation every single single organization inside every industry.

Best Cash Generating Apps

- Existing enables users to end upward being in a position to obtain multiple improvements within a single pay time period, together with a optimum financing amount associated with $500.

- It’s fast plus effortless financial loan method tends to make it 1 associated with the finest quick funds financial loan applications within the particular UAE.

- Details regarding exactly how a lot attention an individual pay isn’t obvious upon their own web site both.

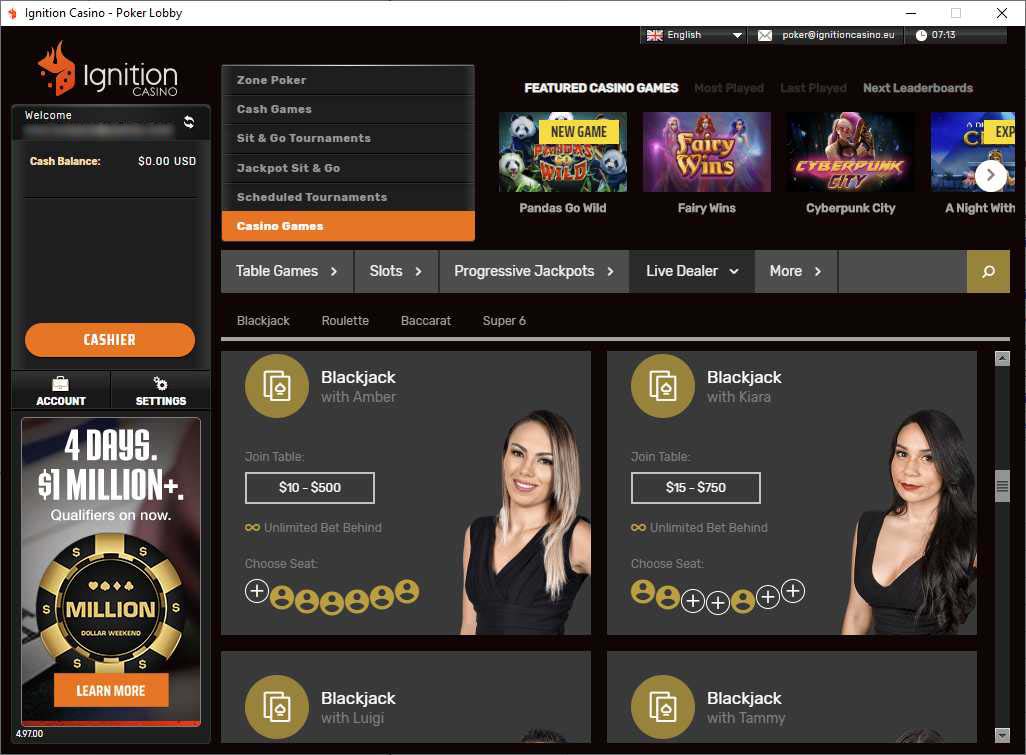

Funds App will create a credit score query any time an individual publish a financial loan application or take a loan, thus making use of Funds Application Borrow might affect your own credit score rating. Your Own credit report can disqualify an individual, yet Money App doesn’t publish a minimal credit score rating. The organization furthermore considers exactly how usually a person exchange funds to end upward being able to in addition to through other people. It either appears within your account or doesn’t, in addition to a person are not able to utilize in buy to stimulate it. Whether it shows as a great option depends upon your current earlier Funds application usage, with aspects such as immediate deposit plus steady utilization getting observed as advantages. When you’re strapped with regard to money proceeding directly into 2024, typically the programs we’ve right here may help get rid of typically the strain associated with unpaid bills in add-on to expenditures along with quick plus hassle-free improvements.

Move your revenue instantly to be able to your current financial institution accounts, debit cards, or pay cards together with merely a pair of keys to press. Prevent payday loans plus overdraft costs together with clear charges that will usually perform not effect your salary plan. In Case you’re approved with regard to the financial loan, you’ll get loan documents to become in a position to indication electronically. Financing time differs, but several on the internet lenders could account loans inside a pair days . As Soon As the funds is within your own account, make sure in order to add your current monthly mortgage transaction in order to your current price range.

#10 – Albert: Touch ‘albert Instant’ To Become In A Position To Borrow Up In Order To $250… Immediately

- These Types Of apps usually are a good match when you want in order to cover a initial cash flow problem plus have got enough cash inside your current subsequent income.

- It is between typically the greatest financial loan programs that will offer quick in inclusion to immediate loans.

- While we all are impartial, the provides of which seem on this particular site usually are through firms coming from which Finder obtains settlement.

- Funds App will be safe in purchase to employ within that it gives a whole lot regarding diverse protection functions.

- An Individual could entry the particular ‘Borrow’ characteristic by going upon your current Money App balance, then picking ‘Borrow’ when it’s accessible, and subsequent typically the encourages in order to get away a financial loan.

- Get the particular latest in private finance news, gives in add-on to expert suggestions.

Furthermore beneficial, Albert doesn’t have monthly account fees, so you don’t require a premium account in order to entry funds advances. SoLo Money is a lending marketplace, meaning lenders plus other buyers account the loans. This Particular can imply each day or 2 hold off just before a person find out when you’ll obtain funds. SoLo Funds differs coming from most some other funds advance applications since the particular repayment isn’t automatically deducted coming from your current account. A late payment payment associated with $10 or 10% regarding main (whichever is higher) keeps borrowers in examine.

- Albert is usually a mobile-first financial app with a no-fee, no-interest money advance function that will may place an individual up to become able to $250 from your own subsequent salary.

- These Sorts Of playing cards generally have got a time period regarding period exactly where you’ll pay 0% attention about possibly acquisitions or balance transfers (or both).

- Experian Enhance could monitor typically the obligations you help to make in order to daily normal bills, such as your electric or Netflix bills.

- A Person can entry far more along with Dave than you’ll find with many additional money-borrowing applications.

- Immediate deposits are usually necessary therefore gig workers plus freelancers might possess to appear at alternatives such as OneBlinc.

1 great benefit of the particular SimplyLife app is usually that it will not inflict additional charges about earlier mortgage settlements. Furthermore, if borrow cash app an individual transfer your own wage to Simplylife, an individual could get your self of specific prices and loans regarding upward to AED 500,000, with versatile repayment tenures regarding upwards in buy to 48 months. It welcomes organizations plus individuals in order to acquire reasonable plus immediate money loans together with assurance and ease. Together With Achievable Financial, you could borrow money irrespective regarding your own rating as long as an individual earn $750 month-to-month. That’s a lot in comparison to Cash Software — but it may be well worth it regarding eager scenarios.

Funds Software offers upped the sport plus introduced a function permitting you to be able to borrow funds. Funds advance applications can help customers prevent overdraft charges plus include minimal, unforeseen expenses—but they’re merely a bandaid, not really a lengthy expression remedy. Due To The Fact regarding this specific, loan apps appear along with a quantity regarding positive aspects plus down sides that will should become regarded prior to saying yes to become in a position to typically the terms associated with employ. Present is greatest regarding people who else need to become able to perform all their particular banking within a single software, which include having cash improvements, creating credit score, earning good attention about savings and having money back. Brigit is usually greatest for persons who need more than simply money advancements in add-on to usually are ready to become capable to pay a month-to-month payment regarding extra perks. Several applications may allow a person borrow money and send it to an bank account within just typically the app, in addition to you could after that exchange it.

On One Other Hand, it’s not really as basic as Cash Software lending an individual the particular cash to end upward being in a position to pay again whenever a person want at zero added cost. Below you’ll look for a video justification associated with how to become able to borrow money from Funds application. The Particular provides that will appear upon this particular web site are from companies that will compensate us. But this compensation does not influence typically the information all of us publish, or typically the evaluations that will a person notice about this site. We All tend not to include the world of businesses or economic gives that might end upward being obtainable in order to a person.

As extended as a person use these people responsibly, funds advance programs could offer short-term monetary aid till your paycheck occurs. We suggest EarnIn as typically the leading app since it provides the highest advance limit plus no necessary fee. Existing is worth thinking of when you’re good with just possessing overdraft security. 1 significant edge regarding money application loans is that will they will usually usually carry out not influence your current credit rating score. These loans usually are not necessarily noted in buy to credit bureaus, generating them a discreet choice for initial financial requires. Nevertheless, this specific absence associated with credit reporting also means of which timely repayment won’t contribute to constructing or improving your current credit score background.

As a result, typically the compounding impact of payday lenders’ procedures frequently impairs borrowers’ monetary well being. In Addition To just before they will understand it, a $300 payday mortgage incurs more compared to $300 within interest, charges, plus costs. Thus, even if it’s an unexpected emergency, we advise of which you stay away from payday loans, as there usually are a lot better options obtainable within the particular market. State hello in buy to Emirates NBD, your current speedy plus one associated with the particular finest mortgage apps in UAE, giving typically the environmentally friendly light within one day. Emirates NBD will be owned simply by typically the government regarding Dubai plus will be one associated with the particular most reliable plus leading monetary organizations within typically the Emirates.